Libertystream Infrastructure Partners

Libertystream Infrastructure Partners Strategy analysis

Libertystream Infrastructure Partners (OTC:VLTLF / TSXV:Lib) formerly known as Volt Lithium, is facing a unique opportunity, much bigger than an ordinary lithium mining company.

Lithium - Growing Demand

Growing lithium Demand has positioned the United States dangerously tethered to Chinese lithium, importing nearly its entire supply.

While domestic production accounts for less than 2% of global output.

This reliance has triggered an urgent push for local sourcing to ensure national security and supply chain resilience as EV and grid-scale storage demand outpaces available lithium.

Despite a wave of planned U.S. projects, production capacity is nowhere near ready to feed the massive lithium demand, especially as projects keep pushing production deadlines.

Prices have already skyrocketed past $25,000 per tonne following the dramatic shutdown of major Chinese mines, such as CATL’s Jianxiawo facility in Jiangxi.

Our reality will demand a whole new industry of lithium production and recycling to support a full industrial cycle for North America.

Background-Volt Lithium

In 2022, Allied Copper&Volt Lithium had a chemical breakthrough, achieving 93% lithium extraction from brine.

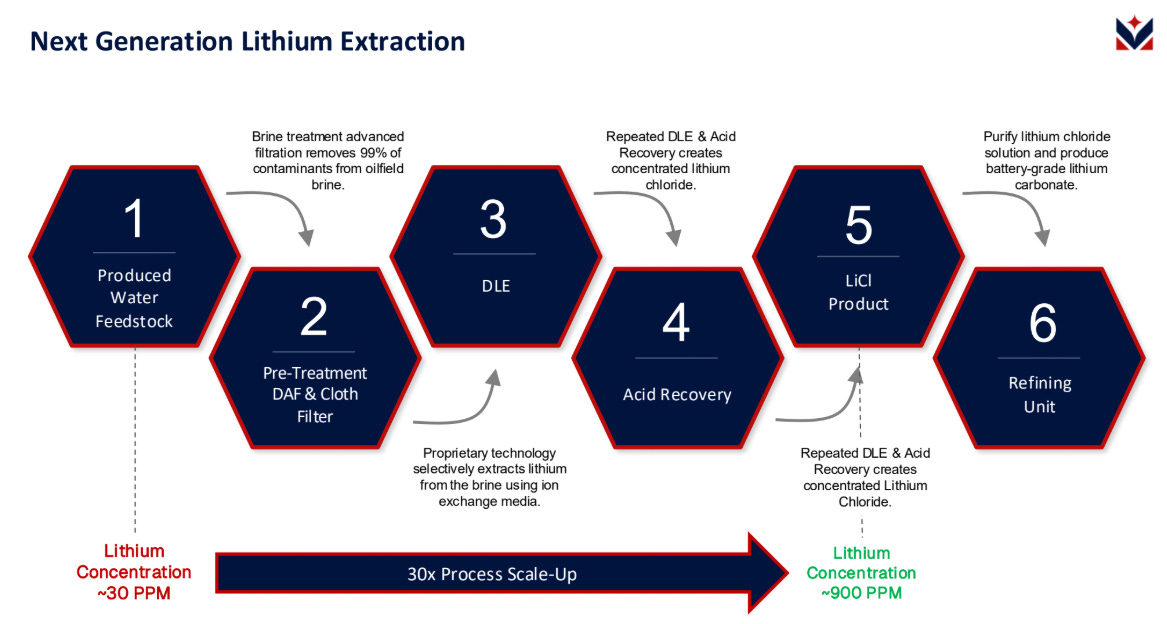

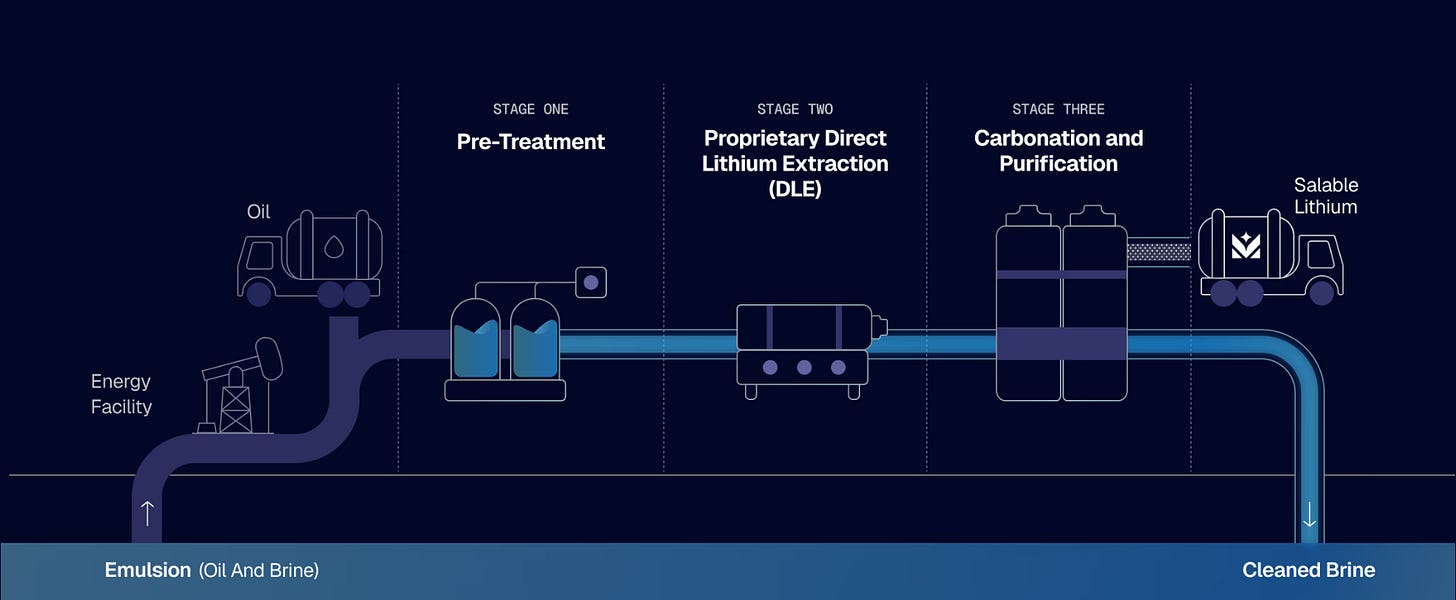

Their approach is a form of DLE, originally deployed by evaporating pools of lithium-rich water, a process that can reach 2 years per cycle, and in modern versions by pumping up lithium-rich brine and performing extraction.

They achieved it by using their specialized material (sorbent) that selectively “grabs” lithium ions while allowing other minerals and water to pass through.

As lithium demand emerged, they chose to make lithium production their main goal, and completely branded themselves as Volt Lithium.

After having their chemical breakthrough, that’s when their engineering journey began. They tested brine from basins across North America and developed their pilot plant in Canada, kept improving their process and achieved an impressive 99% extraction rate.

Until they formally completed their full 3-stage process from brine to lithium carbonate, which still stands today.

Later on, they began working with major oil&gas operator in the Texas Delware basin. Being supported financially by a strong partner, they deployed their first field unit in Texas in Q3 2024.

That is when they saw the BIG Opportunity, The Permian Basin.

DLE - Direct Lithium ExtractionLibertyStream Infrastructure Partners

Ordinary DLE projects use lithium-rich brine with concentrations ranging from hundreds to thousands of mg per liter.

The Permian Basin brine usually contains only 30-100mg per liter of lithium.

So, naturally, the industry ignored the possibility of DLE for this brine.

Mostly because of the lack of ability to extract lithium economically at such a low concentration.

Being able to extract lithium from low concentration as ~30mg per liter, With a low cost of Sub 4k per tonne, they were and still are probably one of the best known options for lithium extraction in the Permian.

Why the Permian Basin?

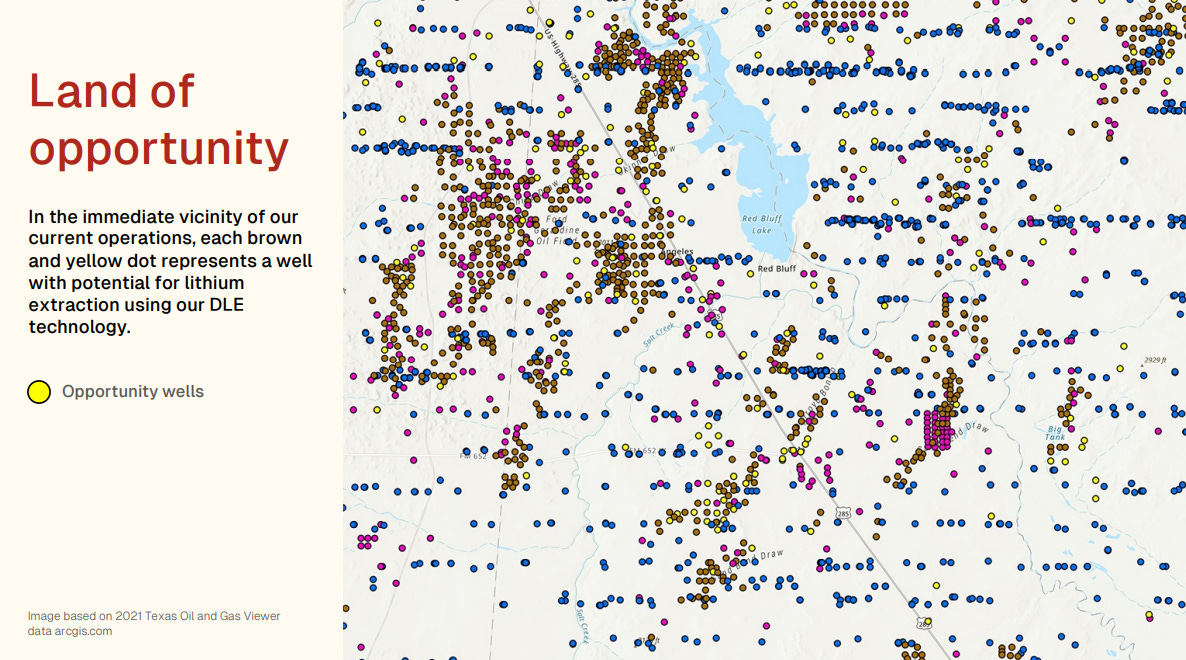

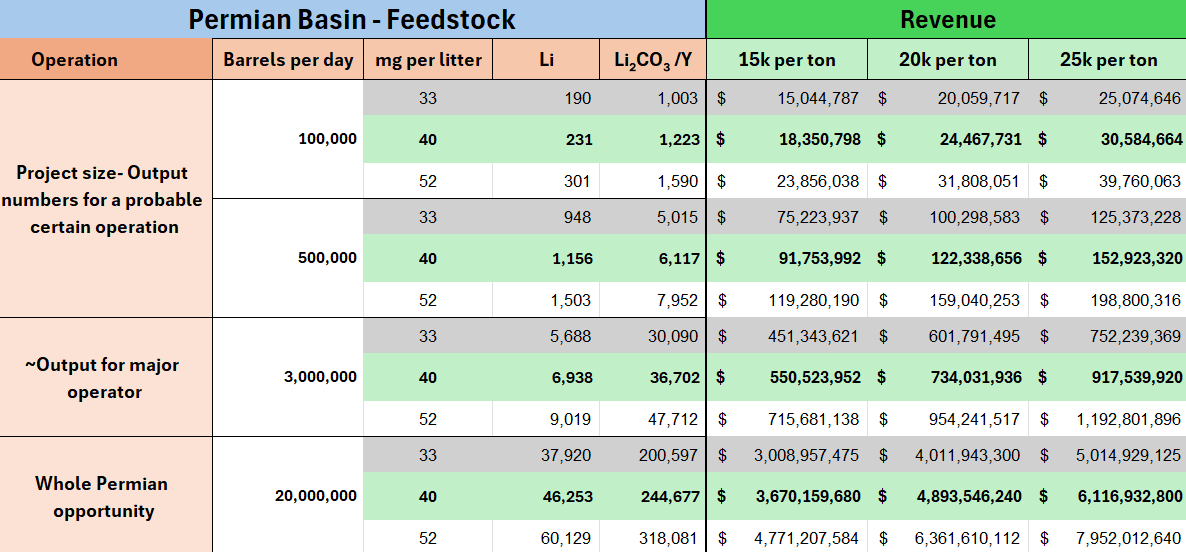

In the Permian Basin today there are 20 million barrels of brine being pumped up to the ground every day as a byproduct of the oil & gas industry, potentially 200k tonnes per annum of LCE.

Moreover and most importantly, the infrastructure is set.

No need for permits, mines or wells, the Permian Basin infrastructure is already set from top to bottom.

That’s why they renamed themselves- Libertystream infrastructure partners.

LCE - Lithium Carbonete EquivalentSource: Libertystream Infrastructure Partners investor presentation (07/2025)

The Players

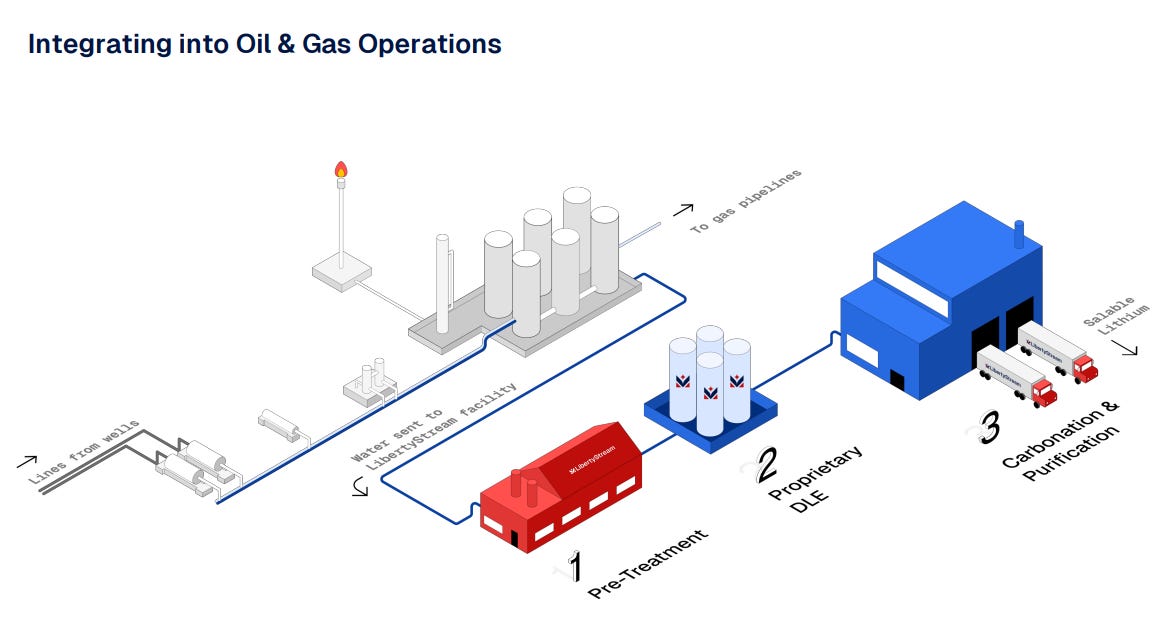

Currently, there are two main roles in this process, companies that lift the brine to the ground as a byproduct of oil and gas extraction and a group of midstreamers handling that brine for disposal.

LibertyStream Infrastructure Partners aims to leverage that existing infrastructure and add value with their modular units by adding one more step to that journey.

Meaning that deploying their whole operation from signing off-take to commercial operation is a matter of Months.

Source: Libertystream infrastructure Partners investor presentation (07/2025)

Bakken Basin

More to that matter, Liberty is also operating in the state of North Dekota.

Having revealed a partnership with Wellspring Hydro, which aims to be a major midstreamer of the Bakken Basin.

The Bakken Basin brine is more lithium-rich, where approximately 2 million barrels per day of brine marks the opportunity for 40k tpa of LCE.

Lib’s Process

In order to understand their process and how impressive their milestones actually are, we need to scope out.

Lithium production is a really simple way to describe a very complex process

Initially, extracting the lithium is the easy part, where the struggle is to reach a high purity product for later further refining.

Many are failing to achieve those high purity levels consistently.

It’s a very complex process where theoretical lab results won’t guarantee on-site success.

Not only because it is a really complex process, but the industry requires consistency, high purity and reliability, especially when it comes to batteries.

Even industrial consumers will not settle, their contracts and liabilities stretch decades ahead and there is no room for less than a proven product.

Source: Libertystream Infrastructure Partners investor presentation (11/2025)

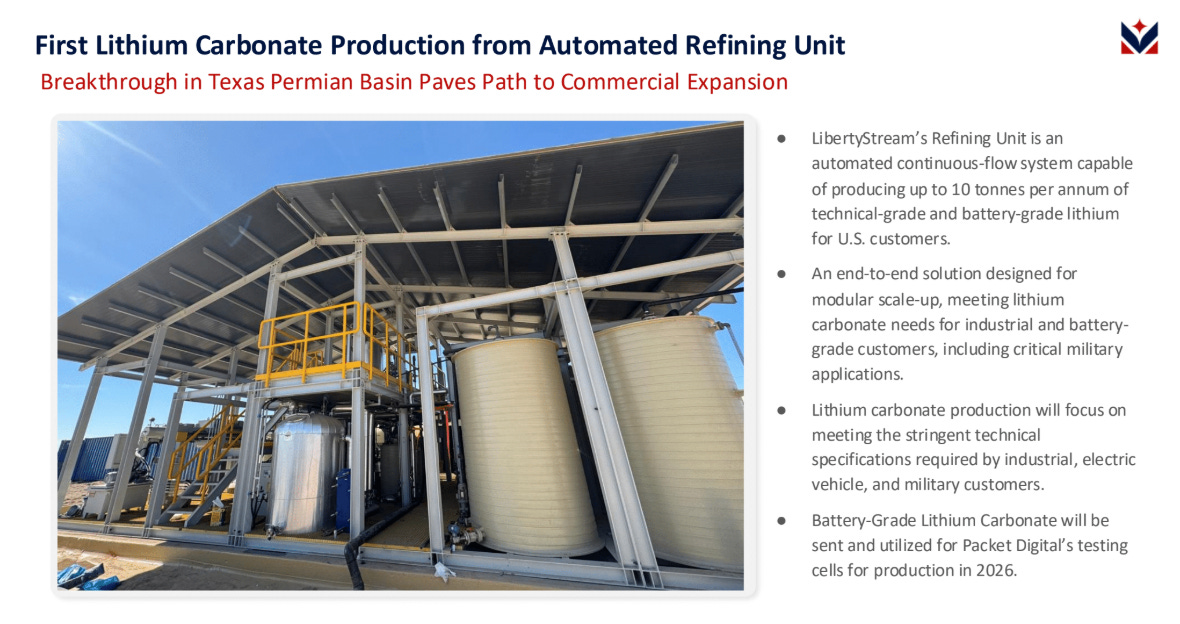

So far, Libertystream has run 2500 field tests and processed over 350,000 barrels of brine, perfecting their own process, reaching the required purity levels.

Libertystream has commissioned into their field operation a refining unit which was the last step in the complete process, Successfully produced Lithium Carbonete on site and validated its purity and consistency by a 3rd party lab.

“LibertyStream Achieves Consistent, Spec-Compliant LithiumCarbonate Production from Automated Refining Unit in the TexasPermian Basin”

Just to emphasize how big this milestone actually is out of all lithium projects in North America, you can count on one hand how many reached this milestone on a commercial scale.

This marks the last step before commercial agreements which should be declared in the coming months.

Infrastructure

Midstreamers usually connect a number of well-disposed brine’s using piping systems into one hub which usually handles between 15k-150k barrels per day.

Lib developed modular units that fit into those hubs performing their extraction.

That kind of engineering enables adaptivity and fast growth by setting up multiple units to meet required demand, all in a very short timeline (months).

Source: Libertystream Infrastructure Partners investor presentation (11/2025)

Future ventures

Lib own its tech, which gives them the ability to improve and expand.

At their site, they show 6 other critical minerals as a possible future venture, as for now Lithium is their main project.

Business strategy

The next chapter explains what makes their opportunity so unique.

Business model

Their business model, just like their tech, is about input and output.

They will sign feedstock agreements for their water supply, and later on sign off-take agreements to deliver their product.

As for the input, the top 4 midstreamers in the Permian handle almost 9 million barrels every day, meaning partnering with each one of them sets a scalable path to 10k-30k tpa.

For the off-takers, they will take advantage of their ability to begin small.

They will probably sign 500-1500 tpa agreements to drive their revenue stream, raise capital and earn experience for their next projects.

The real difference

Lithium producers and generally mining companies have to perform studies, get permits and only then, after years, do they get to spend billions setting up their infrastructure.

Not only does the whole process take years and vast capital expenditures, they need to plan their operations based on huge outputs to support that long process economically.

That is why almost all other companies cannot begin small, get better and grow, as logic demands every healthy process.

Projects set to produce 30K tpa in 5 years cannot expect what issues nor delays they will face, they have to face them as a problem in a billion-dollar project.

Libertystream, by not having to set up infrastructure or get permits, only had to perfect their own tech and modular units engineering.

That is why they are already shipping their finished product to potential customers years before most projects in North America.

Source: Libertystream Infrastructure Partners Website (Q1 2026)

Multipling

As explained earlier, reaching that high purity final product is a very tough mission.

Not only are theoretical lab results hard to pull on site, repeating a pilot site success on a massive scale is a very long, hard and complex mission.

Lib recently managed to prove their process on a 10k barrels per day unit.

They don’t need to repeat their success on a larger scale, they simply need to copy and paste.

By setting multiple units with a proven process and repeating it on hubs across the Permian & Bakken.

That is what their infrastructure demands.

In some ways, that is what makes their operation proven on a commercial scale.

EV companies require up to 2 years of consistent product to validate its purity and matching, And Industrial consumers require months.

Lib’s countdown has begun as they began shipping bulk samples of Lithium carbonate to potential customers.

The right place at the right time

The cherry on top for Lib is their timing.

Besides emerging prices, environmental laws push SWD regulations, and the Midstreamers process becomes more expensive, requiring economic improvements.

Although midstreamers may seem like the modern part of the Industry, they are part of decades-long non-stopping operations.

By providing services for long-term operations, they need another player to make the bold move.

Their internal improvements take years as providing their initial services comes first in order to support their long-term commitments.

Libertystream is well positioned to improve that multi-billion industry by being able to be innovative.

More to that timing, the USA's urgent demand for a secure supply chain to support its Economy and Militarry are both matters of national security. That is why demand for domestic supply grows, and domestic lithium will be priced at a premium for long-term agreements.

They need to improve their economics and Libertystream is their Solution

SWD Salt Water DisposalAlex Wylie

Libertystream CEO Alex Wylie, the biggest shareholder.

With vast experience in the oil&gas industry, Finance&Accounting and Investment banking. Alex is proving himself as a true leader.

Alex is leading Libertystream to a surging industry with an innovative approach, proving to know how to execute by turning shelf ideas for on-site success.

After following this company for a long time now, Not only was I impressed with its outstanding milestones and meeting their deadlines, but I was delighted to hear his own words in interviews about how hard it was.

Dealing with engineering and operational struggles in order to achieve these milestones, leaving his family in Canada to live in a trailer in Texas near the site to make sure they meet their goals.

Giving me the confidence Alex and his team can overcome what may come next.

Tim Frost

“LibertyStream Appoints Former Albermarle Veteran Tim Frost as Advisor Strategic Alliances”

Tim Frost is a strategic recruitment.

Over 15 years of experience in Albermarle being in charge of over 800 million worth of lithium sales.

His experience of interacting with buyers, their needs and broader understanding of this business will provide Libertystream a strategic advantage entering the sales phase.

Operations - Permian&Bakken Basin’s

Permian Basin

As of today, Libertystream has admitted to having a major partner under NDA, Supporting their Delware operations.

In addition, they admitted to being approached by many big midstreamers in the Permian and possibly working with more midstreamers in the future.

At the moment, they have a field unit shipping validated lithium carbonate to potential customers aiming to formulate a feedstock agreement and an off-take in the near term (Q1-Q3 2026).

The latest financing was an act of preparation and intention to support these developments with capital readiness.

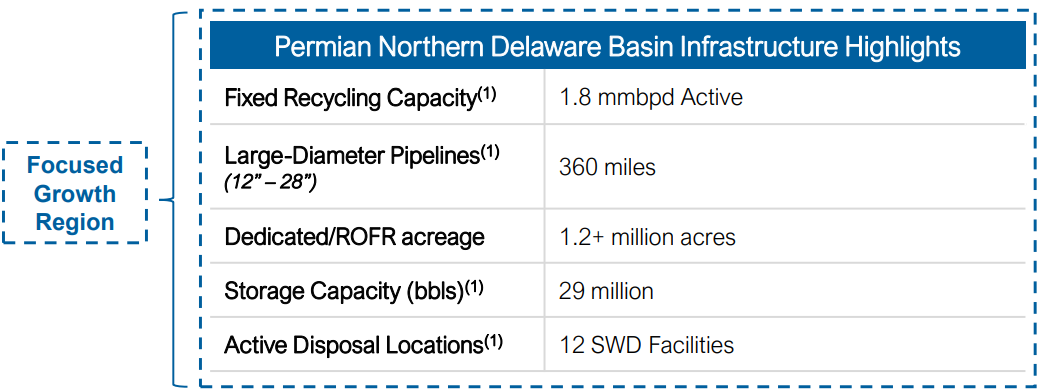

The first Feedstock agreement has been signed between Libertystream and Select Water Solutions, a major Midstreamer in the Permian Basin handling over 3 Million barrels of water for disposal every day.

Select Water Solutions 02/2026

Select Water Solutions and LibertyStream Infrastructure Partners Announce Definitive Agreement

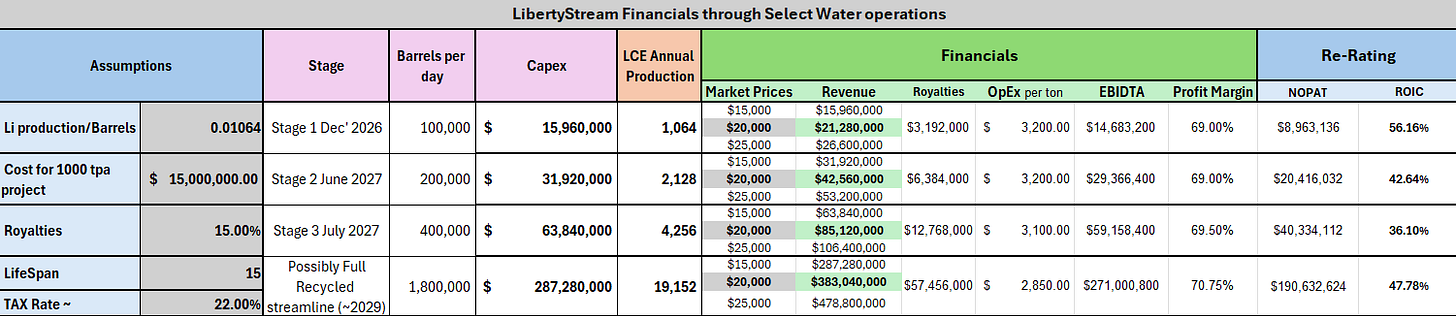

Select Water Solutions has reached a definitive agreement with Libertystream to produce at least 4000 tons per year of Battery grade lithium carbonate.

Select will provide the water through their recycling facilities and handle the Pre-treatment, where Liberty will pay them royalties for the produced lithium.

Select Water Solutions Fixed Recycling Capacity is 1.8 million barrels per day in the Permian Basin, setting a growth path to ~15-20k tpa.

Source: Select Water Solutions Investor Presentation (Q4 2025)

The fact that Select is handling the pre-treatment through their full recycling operation, should lower Lib’s sub 4k Operation Costs even lower.

In other operations, Select has been paid about ~15% royalties, giving us perspective on the nature of the deal.

Select’s water recycling and pre‑treatment capabilities will play a critical role in LibertyStream’s lithium extraction process. By removing a major pre‑treatment step required for direct lithium extraction, Select’s systems reduce both capital and operating costs across LibertyStream’s Carbonate Facilities.

That agreement sets real projections for Libertystream near-term financial and goals.

The agreement is set into 3 stages:

Stage 1: 1000 tpa facility of Battery grade lithium carbonate by the end of 2026

Stage 2: Another 1000 tpa facility

Stage 3: At least 2 more 1000 tpa modular units

Financial Breakdown

Assuming the Current agreement covers almost 20% of Select Water output, there is a scalable path to grow further after 2027.

Select Water Solutions are the first revealed partners of Libertystream in the Permian Basin. We can expect more partnerships like this in the future.

Besides

Bakken Basin

At the Bakken Lib has partnered with Wellspring Hydro, as they plan to be a major midstreamer in the area.

This partnership got support from the state of North Dekota, granting money to finance their operations and buying Lib’s refining unit which is currently in Texas, in order to let Lib achieve its customer validation.

The refining unit's actual purpose is to support Lib’s achieving battery grade lithium validated by Packet Digital, a battery manufacturer aiming domestic supply.

Packet Digital

Packetdigital are aiming for production in 2026 and recently got major support for their cause, in the form of 50 million$ grant to support their Domestic supply battery operation - Badland Batteries.

For Libertystream, it may not be the biggest agreement if it will happen, but it marks their ability and goal to produce battery-grade lithium as Packet Digital badland batteries will set high standards for high-performance drone batteries.

Aiming to grow in both basins, they have to be able to reach these purity levels and even though they only have an MOU with Packet digital, the fact they are aiming for production soon is a very good sign that Liberty is in the right direction by being tied.

Source: Libertystream infrastructure Partners investor presentation (11/2025)

Economics

As lithium prices surge, Ton of Lithium cost crosses 20k$ Before import.

Libertystream sub-$4000 domestic production costs, making their operation very viable at even lower prices.

Source: Libertystream Infrastructure Partners website (01/2026)

Their cost for a 100k bbpld project is 20M$, a project that should return ~1000 tpa.

At today's prices, it can generate just over 20M$ per year.

Adding to mind after agreement set, the operation can run within months. These are very impressive numbers.

Domestic product will be priced at a premium, being independent of China, shipping, wars or tariffs.

The first 4K feedstock has been sealed, with Select Water Solutions.

It wont prevent more feedstock agreements supplying water for greater outputs from Select and other Midstreamers.

Every Partnership would have its own terms. Were Lib having ~40M on hand and be generating revenue by the end of 2026, they would be able to support Capex by themselves leveraging lower royalties.

And of course, being open to JV’s partnerships in other cases.

Sub 4k is a figure counting this possible Opex that can be spread in different ways.

As for the Li prices, in the near term, analysts have priced LCE at 15K per ton, yet recent events & Growing demand for energy storage supporting tech developments price has reached over 20k and could grow even higher as most Lithium projects in America are pushing deadlines by years.

Share Price

Traditional junior miners are valued on geological probability (how much is in the ground). Libertystream should be valued on infrastructure throughput.

Making their actual pricing dependent on two main aspects, Market trust and feedstock limitations.

As these projects are easier and cheaper to pull than traditional mines, once an operation is proven it will set the path to unlocking the full value already flowing through their partner's existing billion-dollar pipe network.

As I mentioned, due to their fast-growing capabilities, once Lib is validated on a commercial scale, they will not be rated for their near-term projects but somewhere between there and their possible growth based on their partners’ possible feedstocks.

Based on a very short Return on investment period, they should be re-rated once the near-term projects get clear.

2026 potential milestones

First feedstock Agreement / Partnership reveal (Q1-Q2 2026)

Off-Take agreement (Q2-Q3 2026)

USA Re-domiciliation (Vote is set for Q1 2026)

Nasdaq Listing (Q3-Q4 2026)

Packet Digital developments (2026)

Possibly DOE grant (2026)

First Revenue from the spot market (Q3-Q4 2026)

Credibility

As far as credibility, there will never be better proof beyond successful commercial operation. Until then, we can rely on several milestones:

3rd party lab validation, as good as it gets before commercial operations de-risking their tech and giving investors a clear stamp of trust.

Partner financial support, millions have been spent on these operations continuously aligned with their milestones.

Packet Digital MOU, again,it is not a deal but it sure adds credibility as they intend to begin operations in the near term.

ND grants, just like other investments with stronger confidence in Libertystream credibility.

Enverus- Alex appearance on the innovation underground series may not be proof of a guaranteed investment, but it surely gives credibility when Enverus is a reliable source giving Libertystream the stage.

Disclaimer

This is not financial advice, just my opinion. I am invested in this company.

Not all information is clearly stated by the company and a lot of the info here is my interpretation of news/webinars/Pr’s/Interviews.

Do your own Due Diligence.